Don't Leave your Family Safety Net to Chance!!

I love sharing fun and useful products for parents! Some links I use are affiliate links including links for Amazon.com. I get paid a small commission without additional charge if you purchase from the links. The commissions fund this site to bring parents fun and helpful content! Thank you!

What is a family safety net? A family safety net it the ability to take care of and provide financially for the needs of your family in case of an emergency or death. Examples of this could be…

Savings and Life Insurance accounts

Childcare Options

A Will or Trust

Many parents work hard to provide for their families and care for their children, but are they prepared for the worst?

Nobody likes talking about bad and horrible things happening like…

accidents

disabilities

diseases

or even death

…but as parents, it is our responsibility to consider the effects these situations could have on your spouse and children.

The impact could be devastating.

In such horrible situations, people are distraught and not thinking clearly as they are faced with planning a funeral, keeping up with the bills, and feeding the kids.

We all would love to look into a crystal ball to see what the future holds, and to be able to know exactly what is ahead for our lives. Without that predictability of the future, we are left to make plans for the “just in case” moments.

It’s not easy and it’s not fun, but it is a necessary part of parenting and taking care of a family.

Consider what would happen today if one or both parents were in a deadly car crash?

If both parents are gone, family, friends, and the courts will be left to make decisions about the welfare of your children, your money, and their future.

Who will take care of them?

Will there be fighting over the kids who would be devastated and scared?

Who would take care of the estate and finances for your kids?

If you have no will, your children’s fate could be left up to people and laws that may not have the best interest of your children at heart.

What if one parent is left behind after a tragedy? Is one income enough to support the family if they have a job? Will they now have extra daycare and household costs to manage?

Many families, especially young families are leaving themselves open to these risks.

At a very basic level, setting up a will to cover the care and finances of your children can begin to secure your family safety net.

I am no expert in these areas, but I will provide some strategies and some basic information from government websites and some articles to get you started.

I know these things are hard to think about. It certainly is not a fun blog to write. If parents follow through with a plan, however, it will provide for peace of mind and security for the family!

Once your plans are completed, you will need to re-visit them to add updates, but the hardest part will be over and you can go on enjoying time with your family!

Diving into estate planning can feel overwhelming, so let’s start with some strategies to make the research a little easier.

Strategies

Take advantage of your human resource department at work. Ask for help and any information they have on wills, life insurance, and disability insurance.

Talk with other parents in your network of friends and family.

Have they set up a will? Life Insurance? Disability Insurance? What advice and recommendations do they have?

If nobody has started any plans, are they interested in looking into these things for their family?

Is there a way you can divide up the research process with other families and meet up as a group to review what each parent found? The coverages? The fees? The setup? The laws?

Maybe the group can take advantage of referral discounts?

Is there software available that can help?

Are there free resources you can take advantage of?

If money is tight for software or lawyer fees, ask for help in lieu of holiday or birthday gifts. Place these fee requests on a wedding or baby shower gift registry.

Don’t be afraid to ask questions!

Once you have your will set up and any insurance policies you decided on, consider purchasing a small fireproof safe to keep all of your important family documents in.

Be sure to let 2 different trusted family members or friends know where the safe is and tell them what documents are in there. Will they need a key or a combination to access the papers? I did say trusted family or friends right?

Keep account passwords in a safe place, and let your spouse and one other trusted family member or friend know where they can access them.

You can also look into keeping your documents in a safety deposit box at a bank.

Articles and Resources

You will need a will - even if you’re not “rich” an article from the MarketWatch website by Bill Bischoff.

10 Steps to Writing a Will an article from the U.S. News and World Report by Geoff Williams.

How to Choose a Guardian for your Child an article from the U.S. News and World Report Website by Susannah Snider.

Creating a Will some general information and vocabulary to get you started from the USA.gov website.

Life Insurance general information is covered under personal insurance from the USA.gov website.

Short-term and Long-term disability insurance general information is covered here on the USA.gov website.

Leaving a legacy: Why everyone needs an estate plan by Matthew Goldberg is a great overall article from the Bankrate.com website.

Do you know someone who could use this information to start planning for their family safety net? Share this article and help them get started!

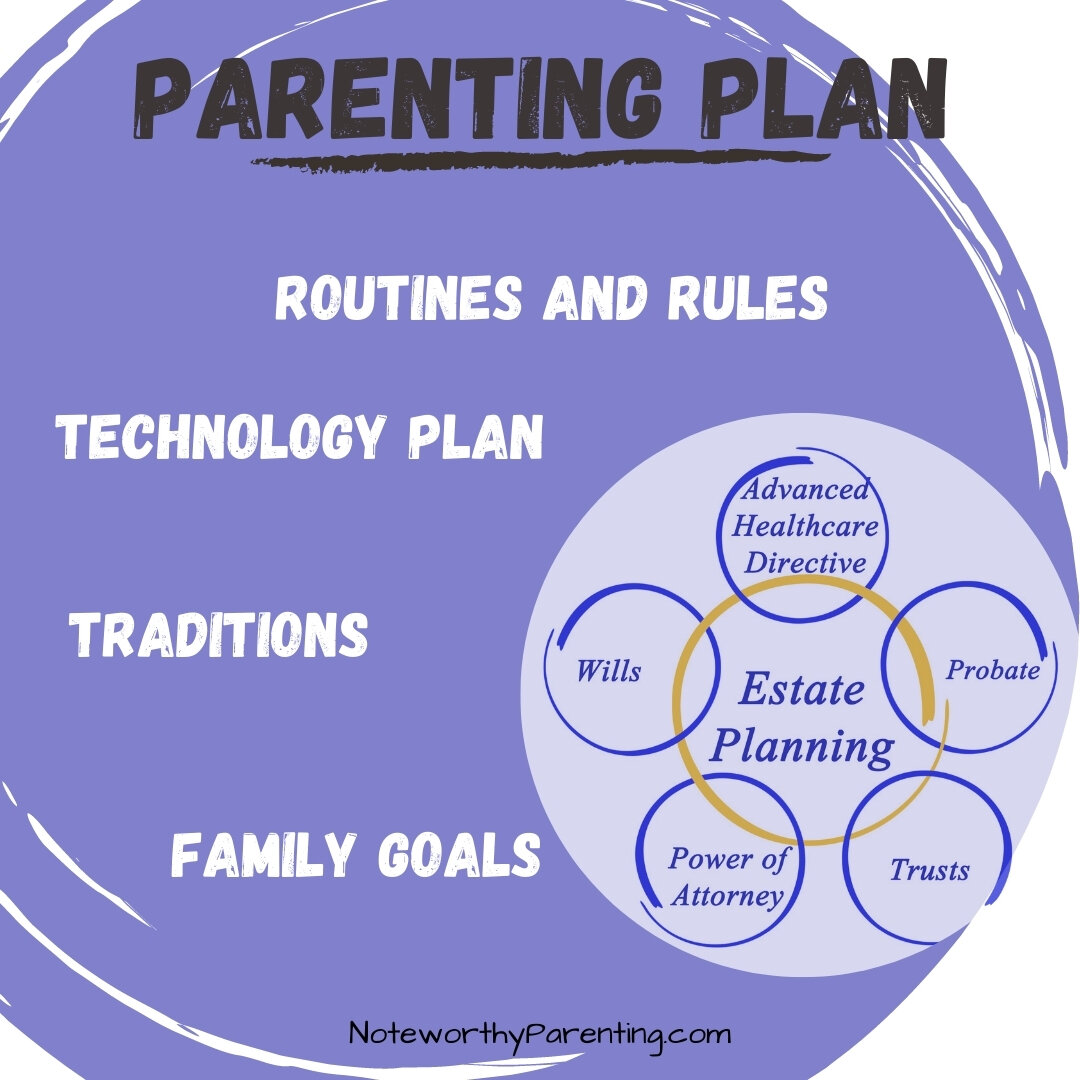

Estate planning should be a part of your parenting plan!